lake county sales tax rate 2019

Map of current sales tax rates. 2021 Lake County Budget Order AMENDED - Issued February 12 2021.

Gross Receipts Location Code And Tax Rate Map Governments

The current total local sales tax rate in Lake County CA is 7250.

. You can print a 775 sales tax table here. For tax rates in other cities see Utah sales taxes by city and county. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

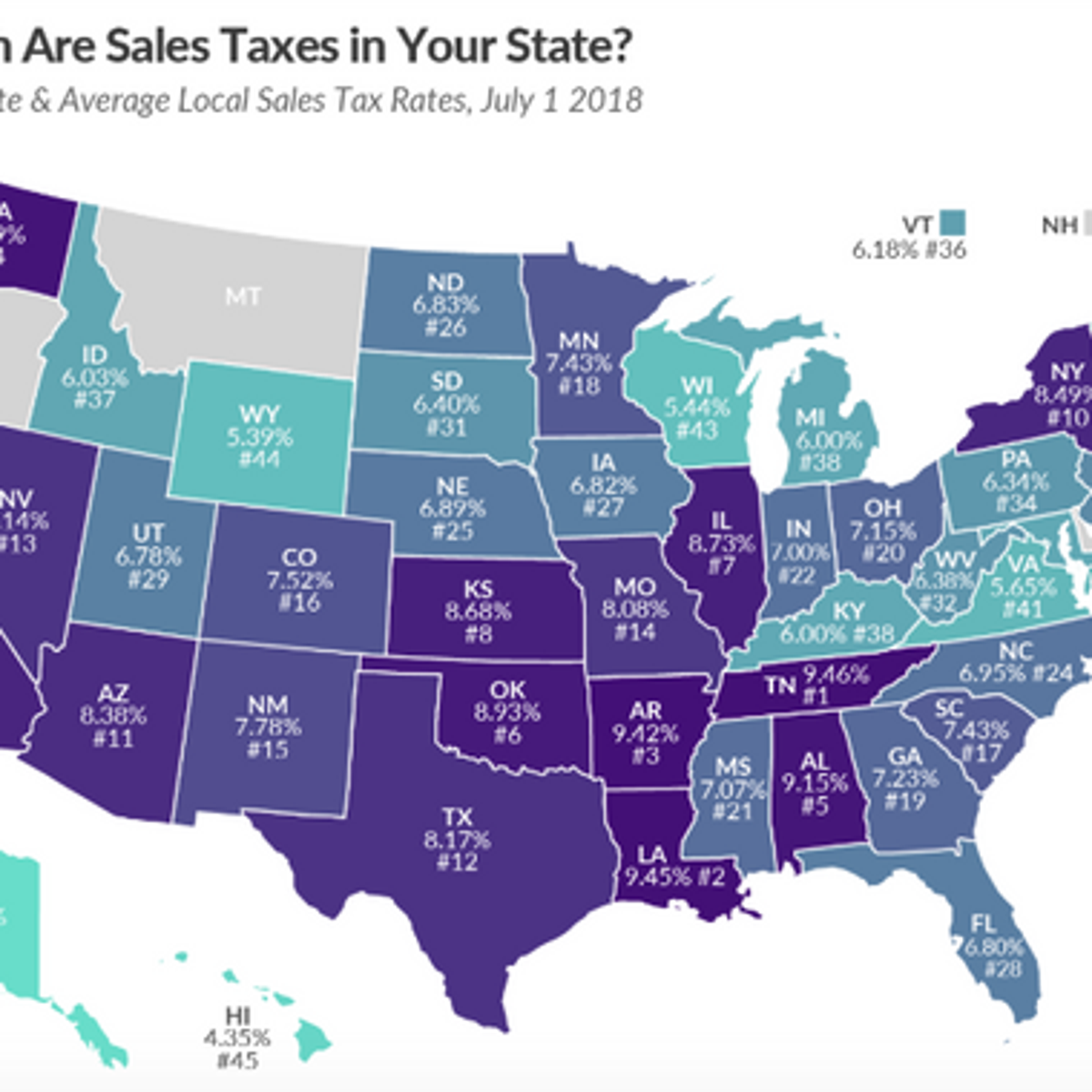

1788 rows Bass Lake. Predominant Rates - 2019. Average Sales Tax With Local.

The 775 sales tax rate in Salt Lake City consists of 485 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. Heres how Lake Countys maximum sales tax rate of 10 compares to other counties around the United States. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 375.

Predominant Rates PDF District Detail Values Levies Rates and Extensions - 2019. Average Sales Tax With Local. Lake Forest Lake County 750 50800 Home Rule Lemont Cook County 9001001000 Non-Home Rule Lemont Dupage County.

Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 88817841970013E-16. 2022 Lake County Budget Order - Issued January 13 2022. 2019 Lake County Residential Property Tax Rates payable in 2020.

Illinois has state sales tax of 625 and allows. The predominant rate for a municipality is the cumulative tax rate at which the largest number of properties is taxed. Heres how Lake Countys maximum sales tax rate of 7 compares to other counties around.

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. If taxes are not redeemed in 2 years vacant property or 25. The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Lake County local sales taxesThe local sales tax consists of a 125 county sales tax.

2020 Lake County Budget Order - Issued January 14 2020. Your actual rate may vary depending on the taxing districts serving your address. The order also gives the total tax rate for each taxing district.

Multiply the market value of the home by the percentage listed below to determine the approximate Real Property Taxes in each community. The December 2020 total local sales tax rate was also 7000. The current total local sales tax rate in Lake County FL is 7000.

After the sale is completed the homeowner of record deals directly with the Lake County Clerks Office for the redemption. 2021 Lake County Budget Order - Issued January 15 2021. Bay Point formally West Pittsburg 8750.

The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County. A county-wide sales tax rate of 1 is applicable to localities in Lake County in addition to the 6 Florida sales tax. At the sale a tax buyer paysbuys the taxes then the county collector distributes the money from the sale to each of the taxing bodies to make them whole.

FL Sales Tax Rate. 2019 Lake County Budget Order - Issued. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

2022 1 st Quarter Rate Change. The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022. The Lake County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in Lake County in addition to the 6 California sales tax.

Historical Sales Tax Rates for Salt Lake City 2022 2021 2020 2019. The Illinois sales tax of 625 applies countywide. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 25.

Higher maximum sales tax than 95 of Illinois counties. 6 rows The Lake County Illinois sales tax is 700 consisting of 625 Illinois state sales. The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022.

The sales and use tax rate for Paulding County 63 will increase from 675 to 725 effective January 1 2022. Further reduction in the tax rate is possible for taxable years beginning on or after January 1 2020 and January 1 2021. The Lake County Sales Tax is 1.

Tax Year 2019. There are a total of 129 local tax jurisdictions across the state collecting an average local tax of 2108. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

Florida Sales Tax Rates By City County 2022

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

Sales Tax In Orange County Enjoy Oc

Ohio Sales Tax Guide For Businesses

Georgia Sales Tax Rates By City County 2022

Budget And Tax Facts City Of Lewisville Tx

Budget And Tax Facts City Of Lewisville Tx

How To Calculate Sales Tax Definition Formula Example

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Arizona Sales Tax Rates By City County 2022

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

Colorado Sales Tax Rates By City County 2022

Tax Structure City Of Hendersonville

California Sales Tax Rates By City County 2022

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com